By Siddhi Nawar

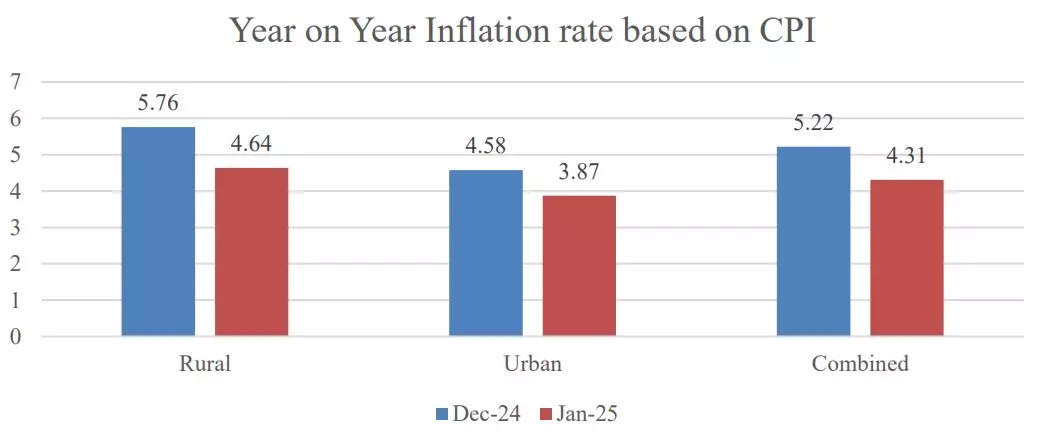

India’s Consumer Price Index (CPI) based inflation in the month of January stood at 4.31%, as per data from the Ministry of Statistics and Programme Implementation. A significant decline was observed across both rural and urban areas, bringing relief to consumers.

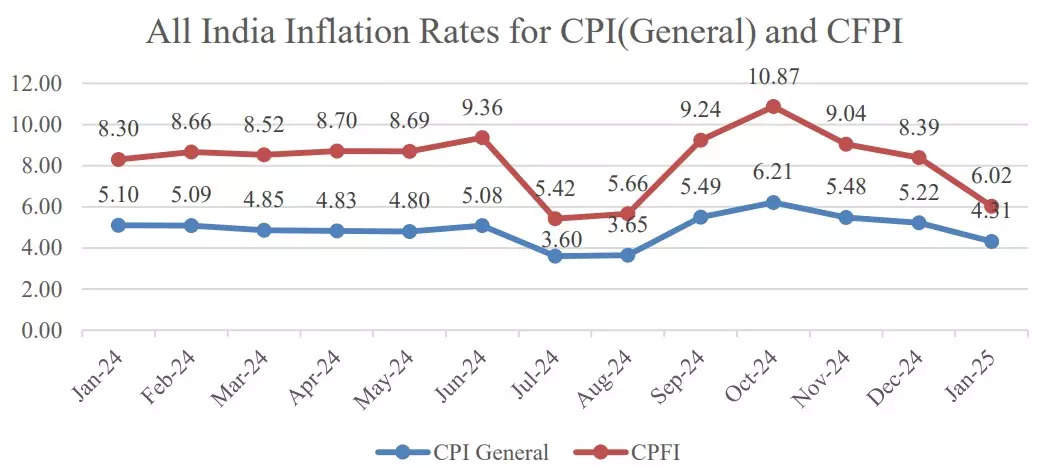

This marks a decline of 91 basis points, from December’s retail inflation of 5.22%. Inflation in both rural and urban sectors witnessed a notable decline in January 2025, particularly in food prices– a major indicator of Consumer Price Index (CPI).

Rural inflation dropped to 4.64% from 5.76% in December, with food inflation falling from 8.65% to 6.31%. Urban inflation also declined, with headline inflation down to 3.87% from 4.58% and food inflation decreasing from 7.9% to 5.53%.

“Continuous softening CPI inflation will boost consumer demand and stimulate production activity in the country,” said Hemant Jain, President, PHD Chamber of Commerce and Industry.

“Going ahead, assuming a normal monsoon and good kharif production, we expect the CPI inflation to remain well within the RBI’s target band,” said Hemant Jain.

The movement of Retail inflation has been on a downward trend since its peak in October 2024, at 6.21%. Here is the movement of India’s Consumer Price Index in FY25, so far:

Apart from food prices, other sectors of the economy marked substantial shifts.Housing inflation slightly increased to 2.76%, while education and health inflation eased to 3.83% and 3.97%, respectively.

Transport & communication inflation rose marginally to 2.76%, and fuel & light inflation remained in negative territory at -1.38%.

The overall decline was driven by lower prices in vegetables, eggs, pulses, cereals, education, clothing, and healthcare. However, some essential items saw high inflation, including commodities like coconut oil (54.20%), potatoes (49.61%), and garlic (30.65%), as per the MoSPI release.

Sharing her views on January’s retail inflation, Upasna Bhardwaj, Chief Economist, Kotak Mahindra Bank said, ” January CPI inflation moderated sharper than expected led by significant easing of food prices. Meanwhile core inflation inched up a bit to 3.7%. Overall, we expect the inflation trajectory to remain benign in the months ahead to provide room for another 25bp of rate cut by the MPC. However, the pace of INR depreciation will need to be closely watched for spill overs on domestic inflation.”

Index of Industrial Production (IIP)

India’s Index of Industrial Production (IIP) grew by 3.2% in December 2024, down from 5.2% in November. Sector-wise, Mining expanded by 2.6%, Manufacturing by 3%, and Electricity saw the highest growth at 6.2%.

The Quick estimates of IIP rose to 157.2 up from 152.3 in December 2023, with sector indices standing at 143.1 (Mining), 156.2 (Manufacturing) and 192.8 (Electricity).

cpi-inflation-eases-to-5-month-low-at-4-31-in-january-cfo-news-etcfo

cfo.economictimes.indiatimes.com

2025-02-12 11:30:54